Fractional Shares Investing: Pros & Cons

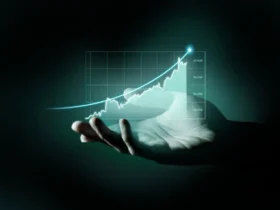

Thanks to modern technology, when it comes to investing, you have options – and we mean a LOT of options. These benefits can make your life as an investor much easier, but they can also lead to some confusion. Thankfully, the barrier of entry to investments has become much lower, and more and more people can invest in the stock market. One such example is the rise in popularity of fractional investing.

What is Fractional Share Investing?

Fractional Share Investing is exactly what it sounds like: You invest in a fraction of a share of investment, instead of a whole unit of stock. The article ‘Are fractional shares worth it by SoFi’ notes that “you can buy half a stock if you’re using fractional shares to invest. With fractional shares, it’s possible to buy stock without having to purchase the entire share. Instead, you use whatever dollar amount you have available to build a portfolio.”

Why Fractional Shares Are a Game Changer

Fractional shares represent a democratization of the stock market. If a share is too large for someone to afford under normal circumstances, that’s no longer a problem: Instead, they can buy half a share or a quarter of a share. As such, the sheer value of a share is no longer enough to keep someone from the stock market, and people now can buy any fraction of a share, regardless of the overall price of the share.

Things to Keep in Mind With Fractional Share Investing

All of the usual pros and cons, potential gains, and possible risks of stock market investing still apply here. This means that you can still buy and sell a stock just like normal and that you face all of the usual risks and rewards – just on a fractional level. Indeed, the only thing that changes here is the scale of the gains and losses. There may be times where it is more worth it for you to save up for a more expensive purchase of a full share.

What Are the Pros and Cons of Fractional Shares?

Fractional shares come with many positives. They allow buyers to buy shares of a stock regardless of how expensive the value of that stock is, thus putting even the most expensive stock within the reach of the average retail investor. This opens up a wide array of investment opportunities. This means that investors can now diversify their portfolios.

Of course, there are also real challenges here. Not every platform allows for the buying and sale of fractional shares. Furthermore, the low total value of a share means that transaction fees – particularly if they are flat fees – may threaten to overwhelm someone’s profit when they make a trade.

Fractional shares may be great for your portfolio, but just like any other sale, they require a real investment of time and energy before making a purchase. Make sure to do your homework and research before deciding whether or not fractional shares are worth it for you.

Also Read: What ROI Should Be Expected After Investing in CRM?

Leave a Reply