Candlestick Patterns: Recognizing And Analyzing Popular Candlestick Patterns For Market Analysis

Traders often utilize candlestick patterns as technical analysis to find prospective trading opportunities in the financial markets. These patterns appear when the price of an item increases or decreases over a certain length of time, and they might provide crucial information about the course of potential price fluctuations. The Doji, hammer, shooting star, morning star, evening star, and engulfing patterns are typical candlestick patterns. Accordingly, every pattern has distinctive qualities that traders may use to spot possible buying or selling opportunities.

For instance, the Doji candle is a single candle pattern that denotes market hesitation and may foreshadow a trend reversal. The hammer is another single candle formation that suggests a bullish mood and can indicate an upswing. Conversely, the shooting star indicates a potential downturn, a bearish reversal pattern. The three-candle reversal patterns known as the morning and evening stars suggest possible trend direction changes, and the engulfing pattern, which is a two-candle reversal pattern, indicates that a shift in trend direction is about to occur. Traders may better understand trading possibilities by studying these typical candlestick patterns and how they affect market analysis.

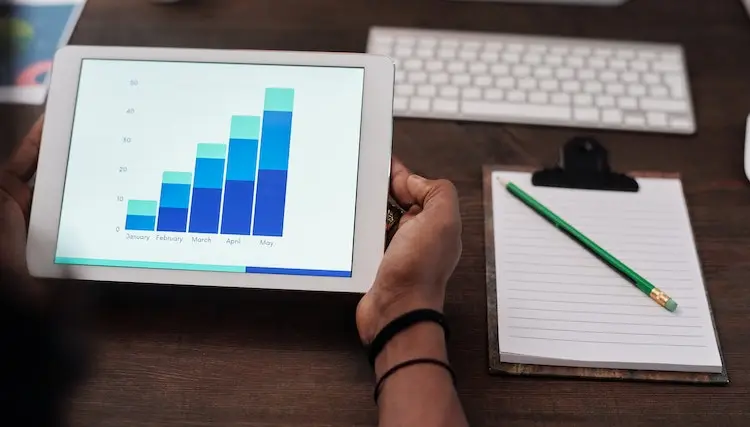

Candlestick charts for market trend identification

For evaluating the strength and direction of market moves, candlestick charts are a standard and helpful tool. They provide users with a visual depiction of price changes over time, enabling them to see future trading opportunities rapidly. The chart has four parts: the opening price, the high price, the low price, and the closing price each time. The candlestick’s body comprises the open and closed prices, while the wicks stand in for the high and low prices. If the body is green or white, the closing price is greater than the opening price; if it’s red or black, it suggests the closing price was lower than the starting price.

On the other hand, more robust purchasing or selling pressure is indicated by longer bodies, while shorter bodies indicate lesser pressure. Long wicks may also point to significant support or resistance levels in a particular market trend. Trading choices may be improved by understanding market mood by analyzing candlestick charts.

Analyzing candlestick chart patterns for probable entry and exit locations.

Searching for patterns that point to a potential trend reversal is crucial while evaluating candlestick chart patterns to pinpoint vital support and resistance levels. For example, you can recognize an uptrend in the market if you see a pattern of higher highs and higher lows. On the contrary, you can recognize a downtrend in the market if you see a pattern of lower highs and lower lows. Once you have discovered these tendencies, you may utilize them to locate possible entry and exit sites. For instance, you could want to search for support levels that the price had previously rebounded off of if you’re seeking a place to enter a long position.

Similarly, you might want to seek resistance levels where the price has previously been rejected if you’re looking for a place to exit an extended position. Trading professionals may acquire important insight into possible entry and exit points in the market by examining candlestick chart patterns and identifying significant support and resistance levels.

Combining candlestick patterns with other technical indicators for trade confirmation and improved decision-making

Candlestick patterns are an effective trading technique because they may provide important information about market mood and help traders spot possible trading opportunities. However, it’s crucial to remember that candlestick patterns are insufficient for trustworthy trading selections. To validate the signals and enhance decision-making, it is essential to integrate them with other technical indications. For instance, if you see a bullish engulfing pattern on the chart, you may examine the signal and determine if placing a trade using moving averages or oscillators like RSI or MACD is worthwhile. Thus, trading choices may be made with more assurance, and trading performance can be increased by combining candlestick patterns with other technical indicators.