How Machine Learning is Changing the Landscape of Financial Trading

A relationship between technology and financial trading has always existed right from the time of telegraph communications up to modern-day advancements.

In recent years, the growing use of machine learning has definitely had an impact on shifting the relationship between trading and technology to a whole new level. Machine learning algorithms analyze vast amounts of data in order to predict market movements and automate trading strategies. As a result, the landscape of financial trading is changing rapidly in many innovative and exciting ways.

The Impact of Machine Learning on Financial Trading

Machine learning is a powerful tool within the financial trading industry. It analyzes vast amounts of data much quicker than a human could ever find possible in order to provide traders with new insights and capabilities previously thought impossible.

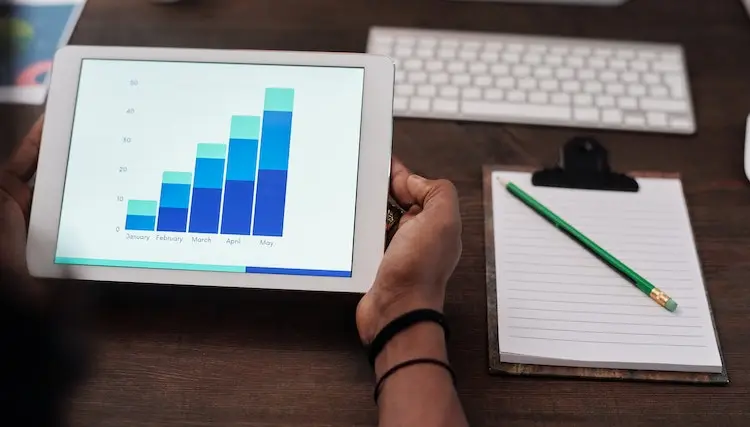

Machine learning can be used to analyze the factors that can affect the value of major currencies, such as interest rates, inflation, and useful economic indicators and this can help lead to better-informed trading decisions. For example, by analyzing these factors and using an algorithmic trading approach, it’s easier to predict changes in the DXY, otherwise known as the US dollar index. This is undeniably useful in leading to more effective trading decisions that have higher chances of bringing in a profit.

Additionally, another major way that machine learning is revolutionizing the trading industry is through the convenient automation of trading strategies. Machine learning algorithms can effectively be trained to accurately identify profitable trading opportunities and execute trades automatically, otherwise known as algorithmic trading. Algorithmic trading is more efficient than manual trading, and many financial institutions have seen benefits in investing heavily in developing it further.

Machine Learning and the Future of Financial Trading

There’s a bright future ahead for the relationship between trading and tech with emerging trends that will surely continue to transform the industry. As machine learning algorithms advance in complexity, they can continue providing traders with useful insights and extended capabilities for increasing trading possibilities.

The current popularity of cloud computing will continue to have a significant impact on machine learning and trading as it makes it much easier to store and analyze all relevant data. Traders can easily access useful algorithms worldwide and this opens doors for smaller trading firms and individuals to more accessibility in trading that was once reserved for the more established players.

Another trend that shows promise for making change is the increasing use of natural language processing to analyze financial data. This allows machine learning algorithms to easily interpret and understand human language. The ability to better analyze unstructured data sources like news articles has the potential to provide traders with more timely and accurate insights into market trends as and when they happen.

The impact of machine learning on financial trading cannot be overstated. This harmonious relationship has already proven itself useful in making positive advancements in the financial trading industry like automating trading processes and providing real-time trend and data analysis. However, the potential of how far this relationship can go seems limitless, as machine learning algorithms become more complex and sophisticated and more money gets invested into developing machine learning technology.