What Are The Main Advantages Of The Banking App?

Have you noticed how most financial transactions go through mobile applications? The relevance of mobile banking is growing by leaps and bounds. Thanks to a special development, in just a few seconds, we can send money from one part of the world to another. So why not learn as much as possible about banking app development?

According to some reports, financial transactions from mobile devices are growing. All banks offer digital banking services through a computer or application.

Digital banking is growing primarily due to the services offered by apps. In particular, last year mobile banking strengthened its position as a reference digital channel. Transactions carried out through a smartphone increased by 36%, in particular, bank transfers and transfers from an account. In addition, the volume of transactions that were performed using desktop computers also increased by a small percentage. If you are interested and thinking about your development, then click here.

The relevance of applications for banking enterprises

All banks participating in the survey claim to offer services through Internet banking and mobile banking. Half offer apps for tablets and a quarter for wearables. Each bank offers an average of three applications, including special applications targeted at certain functions and customer segments. A large percentage of banks offer digital banking services related to loans. In this sense, Internet banking is confirmed as the main referral channel, as well as for the insurance and investment sectors.

A large number of users expect the introduction of the account aggregation service for retail customers in the mobile channel, which will expand the pool of companies offering it. The study also highlights a strong focus on payment features, personal expense management tools and support services, and alternative phone contacts.

With the advent of digital services, the banking world has also focused on fighting cybercrime. Banks are investing heavily in cybersecurity every year. This is all because cybercrime is at a high level and every effort must be made to protect the user’s data. At the same time, they have launched anti-cybercrime activities and initiatives related to staff training, customer awareness, and close and continuous monitoring, aligning protection, privacy, and security with the need for customers to complete transactions quickly and easily on the go. In addition, most banks have established cross-industry partnerships to respond positively to customer needs.

What features does Internet banking usually offer?

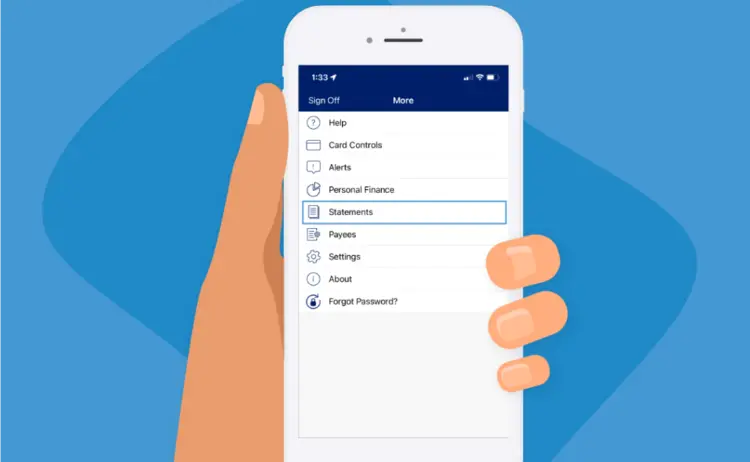

Thanks to Internet banking, users can easily make any transactions directly on their smartphones, as well as manage their finances online. Let’s take a closer look at the main functions:

- Monitoring of funds on the balance sheet. This will allow you to view your spending, and analyze and properly manage money in the future. Thanks to the software, you can see the place, date, and amount that was spent;

- Money transfers. Clients can easily transfer money to almost any card or account. It will be especially easy to do this if it is done inside the bank;

- Payment of bills. Applications provide unique features that allow you to pay bills and make any other transactions in a few clicks.

- Credits. Do you know that now, in order to get a loan, you do not need to go to the bank, stand in line and sign a lot of papers? Now you can apply using Internet banking;

- Notifications. For your convenience, you can use notifications to know about all completed transactions and special offers that are available from your bank;

- ATM. Everyone has come across a situation where you need to quickly withdraw money. In the application, you can view the nearest ATMs, where you can withdraw cash at a commission that is beneficial to you;

- Map management. In the application, you can change the pin code, pay for the service with a card, and in some banks even change its appearance or issue a new card.

Now Internet banking is a real find for users who regularly perform various financial transactions. The features available in the app will depend on the bank you choose. There are even businesses where an online concierge via chat will help you with ticket bookings or online shopping and do it for you. In addition, at some airports around the world, you can use your cards to receive priority services.