The Evolving Role of Public Adjusters in the Digital Age

In an era defined by rapid technological advancement, the role of public adjusters in the insurance industry is undergoing a transformative shift. Traditionally, public adjusters have been tasked with assessing and appraising property damage on behalf of policyholders and negotiating fair settlements with insurance companies. However, the digital age has ushered in a wave of innovations reshaping how public adjusters operate and interact with clients and insurers.

Technology-Driven Claim Assessments: Enhancing Accuracy and Efficiency

One of the most significant changes for public adjusters is the integration of advanced technologies in claim assessments. Digital tools like satellite imagery and virtual mapping software enable public adjusters to conduct remote inspections with unprecedented precision. Instead of relying solely on physical site visits, adjusters can now leverage these technologies to analyze property damage remotely, expediting the claims process.

For a typical public adjuster for insurance claim in Fort Lauderdale, this shift towards technology-driven assessments not only improves the speed of claim processing but also enhances the accuracy of damage evaluations. High-resolution satellite images can capture details that might be overlooked during a traditional on-site inspection, providing a more comprehensive understanding of the extent of damage.

Software Solutions for Streamlining Administrative Tasks

In addition to assessment tool advancements, we increasingly rely on specialized software solutions to streamline administrative tasks. These tools encompass various functionalities, including document management, communication platforms, and project tracking. Cloud-based systems, in particular, have become indispensable, allowing adjusters to access and update information from anywhere, facilitating a more agile and responsive workflow.

For a public adjuster in Fort Lauderdale, a project management software tailored to the needs enables efficient collaboration among team members. This also ensures that critical information is readily available. As a result, internal communication is improved, as well as transparency for clients who can track the progress of their claims in real-time.

Challenges and Opportunities in Data Analytics for Public Adjusters

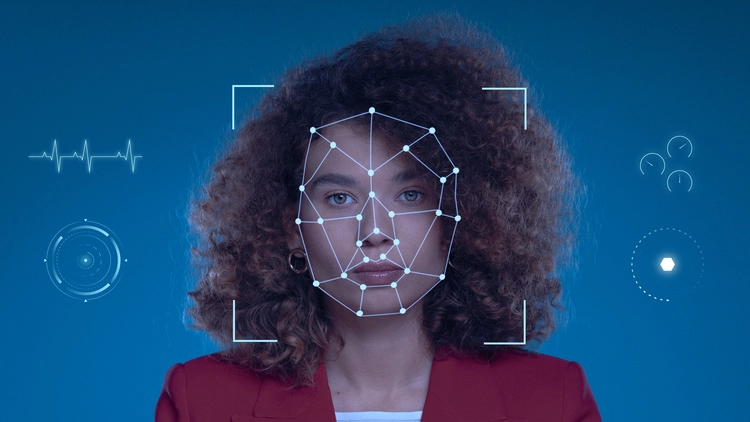

As the volume of data in the insurance industry continues to grow, public adjusters face challenges and opportunities in harnessing the power of data analytics. Predictive analytics tools enable adjusters to assess risks more accurately and anticipate potential issues in the claims process. By analyzing historical data and identifying patterns, adjusters can offer clients strategic guidance on risk mitigation and insurance coverage adjustments.

However, the increasing reliance on data analytics also raises concerns about privacy and data security. Public adjusters must navigate the delicate balance between leveraging data for improved decision-making and safeguarding the sensitive information of policyholders. Regulatory frameworks addressing data protection become crucial considerations in the integration of analytics into the daily practices of public adjusters.

Choosing the Right Public Adjuster in the Digital Age

As the role of public adjusters continues to evolve in response to technological advancements, choosing the right professional becomes paramount for policyholders seeking a seamless claims experience. Here are key considerations to guide the selection process:

Technology Proficiency:

- Look for public adjusters who are well-versed in the latest technologies used in claims management. Proficiency in claims analysis software and other digital tools ensures more efficient and accurate handling of your claim.

Transparency and Communication:

- Opt for a public adjuster who prioritizes transparent communication. In the digital age, effective communication platforms are essential for keeping clients informed about the progress of their claims. Ensure the adjuster is accessible and responsive through various channels.

Industry Experience:

- Consider the adjuster’s experience in handling claims specific to your situation. Whether it’s property damage, business interruption, or another type of claim, an experienced public adjuster is better equipped to navigate the complexities of the process.

Licensing and Credentials:

- Verify that the public adjuster holds the necessary licenses and credentials. In the digital age, where online scams can pose a threat, ensuring the legitimacy of the adjuster is crucial for a secure and reliable claims process.

In conclusion, a symbiotic relationship with technology marks the evolving role of public adjusters in the digital age. As we continue to witness the dynamic interplay between technology and the role of public adjusters, one thing remains clear – adaptability is vital to thriving in the ever-changing landscape of insurance claims.